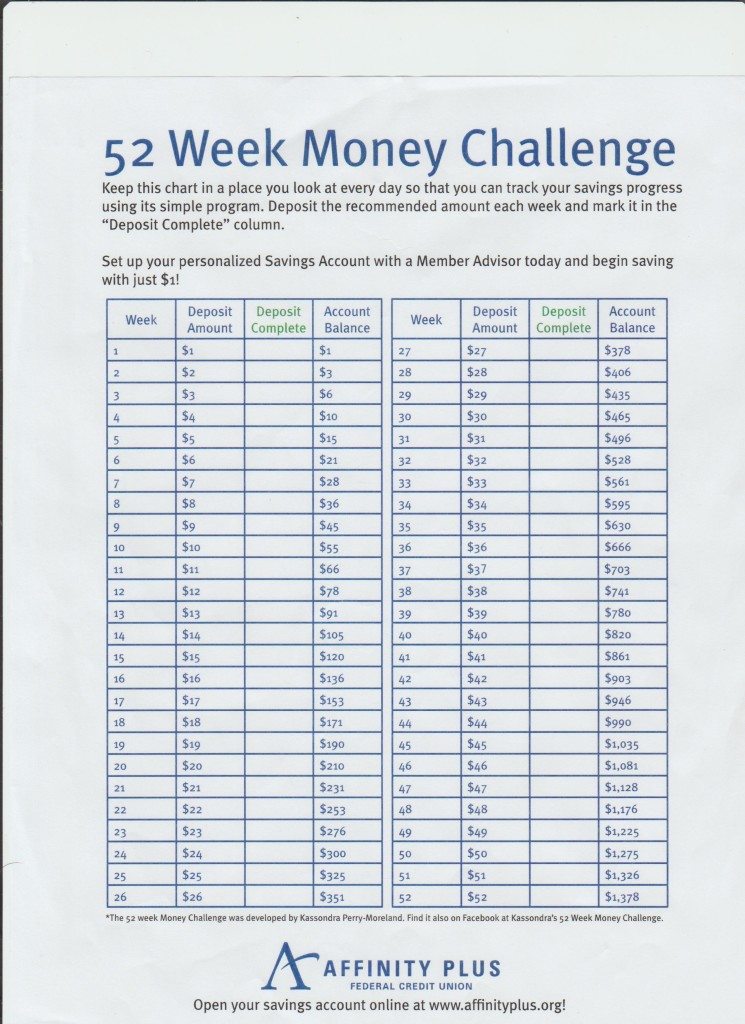

How often do you save? Is it weekly, by weekly, monthly, yearly or never? It is extremely important to have adequate savings in case of emergencies. Why? Because emergencies happen unannounced. It is recommended by financial experts that you should have at least six months of living expenses saved. It takes about six months to find a job after someone is displaced. If you have six months of living expenses saved, your financial burden will be lighter. The simplest way to save for emergencies is to make it automatic. Ask your HR Department to direct deposit a fixed amount of money every pay period towards your emergency fund (in a separate savings account). Imagine saving $100 every two weeks, after 12 months you will have $2400 dollars in your emergency fund (approximately 62% of Americans have less than $1,000 in their savings accounts and 21% don’t even have a savings account, according to a survey of more than 5,000 adults conducted by Google Consumer Survey for personal finance website GOBankingRates.com). Here is a simple way to start saving. With just $1 to start you can have more saved than the average American after 12 months. The 52 week Money Challenge was developed by Kassondra Perry- Moreland. Using this simple system, you can save $1378 at the end of the 52nd week. By tracking your daily progress, you can either deposit the money weekly in a savings account at Affinity Plus Federal Credit Union, or you can deposit it in your piggy bank at home. I hope this can help you to get on the road to a strong or stronger savings account (emergency fund) – happy savings……..